Banks’ pandemic-era bond investments are still hampering some lenders, dragging down the profitability of those that are saddled with low-yielding portfolios for months or even years to come.

The concerns are far less severe than they were in March and April, when the failure of Silicon Valley Bank brought scrutiny of surviving banks whose large bond portfolios were also underwater. The question now is less about whether more banks are at risk of failing — and more about how much their profitability will be squeezed.

The pressures aren’t universal since some banks held off on putting much cash into bonds during the pandemic, or chose shorter-term options that freed up their money more quickly. But those that did buy longer-term bonds before interest rates started rising in 2022 are facing more pain.

Between 2020 and early 2022, relatively few customers wanted loans, and buying a bond that provided a bit of income looked somewhat attractive, even if the interest rate that the banks got paid was just 2% or so.

But now those banks are stuck getting paid 2% — some for a few more years — at a time when they can easily get over 5% on their cash. Expenses are also rising, since they’re paying their depositors higher interest rates and borrowing money to build up larger cash buffers.

So the banks’ net interest margins — a measure of what they earn in interest compared with their interest payments to customers — are shrinking.

“They have underwater bond portfolios, which is really compressing their net interest margin,” said Brandon King, a Truist Securities analyst who covers regional and community banks. “That situation gets worse and worse as long-term rates keep marching higher and higher.”

Low-yielding securities are holding down profitability at regional banks such as Cleveland-based KeyCorp and Charlotte, North Carolina-based Truist Financial. Even Bank of America has faced questions over its pandemic-era bond-buying spree. Its chief financial officer, Alastair Borthwick, said Monday that as those low-yielding bonds mature, the company is freeing up cash to redeploy into higher-paying alternatives.

Also this week, the trust bank State Street said that it sold about $4 billion of bonds to pick up higher-yielding assets.

Other banks that bought fewer low-yielding bonds, such as Buffalo, New York-based M&T Bank, are seeing the benefits of flexibility, as they look to deploy their cash into higher-paying options.

The same picture is playing out at midsize and community banks, some of which invested more heavily in bonds than others.

The losses on banks’ bond portfolios are “unrealized” and only on paper. They’ll only become real if banks are forced to sell their underwater bonds early, rather than hanging onto them until they mature, allowing the banks to recoup their full value.

Analysts say the risks of forced bond sales have dropped dramatically, thanks to the calm that’s been restored after the Federal Reserve launched a program to help banks with underwater bonds.

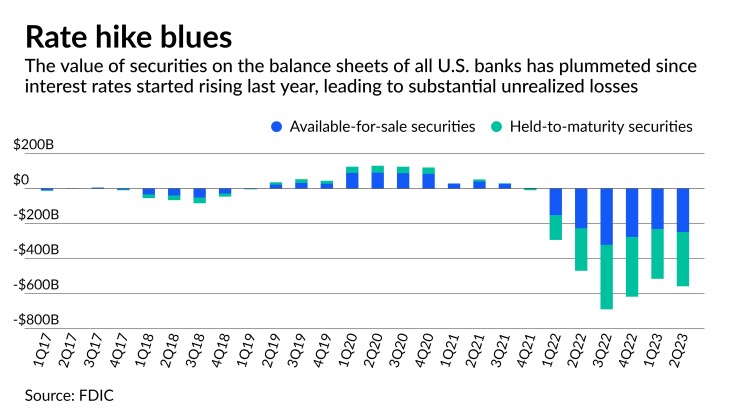

Even so, the scale of banks’ unrealized losses is growing, since higher interest rates make banks’ low-yielding bonds even less valuable. Banks’ unrealized losses jumped 8.3% from the end of the first quarter to $558.4 billion three months later, the Federal Deposit Insurance Corp. said last week. Those figures would likely be even higher today, since long-term interest rates have risen further since the quarter ended.

Markets are adjusting to the likelihood that rate cuts aren’t coming anytime soon — a scenario that’s disappointing to bankers who were hoping lower interest rates would alleviate their bond losses.

The problem “goes away on its own” if the Fed would start cutting rates early next year, said Derek Tang, the CEO of Monetary Policy Analytics.

“But in the event that inflation stays high or the economy is too strong, the Fed needs to keep interest rates really high for longer,” Tang said. “Then the banks are going to be stuck in this situation for an extended period of time.”

The extent to which a bank’s bond portfolio is challenging its profitability is “very idiosyncratic,” said Kevin Stein, an advisor at the bank consulting firm Klaros. A key factor, he explained, is how much upward pressure any particular bank is facing on its deposit costs.

Some banks have large portfolios of low-yielding bonds, but they’ve been able to keep their interest payments to depositors low, thus achieving a profit, Stein noted. Others may be in more competitive deposit markets, or have depositors that demand higher interest rates, such as larger companies whose treasurers are on the hunt for any extra interest.

Loan portfolios add to the challenge, since some bank loans remain stuck at the low rates their clients locked in. The difference between rates a few years ago and today is massive, giving banks another headache as they wait for chunks of their loan books to reset to today’s rates.

“Over time, it will burn off, and those loans will mature, they’ll reprice,” Stein said. “But right now, it’s a very big number.”

Stein and other observers say the question now facing many lenders is whether and how to reposition their balance sheets, including whether to sell their underwater bonds.

The downside of bond sales is that they trigger the realization of previously unrealized losses — as the cash banks get for selling those bonds is significantly less than what they originally paid. As a result, their capital position takes a hit, putting them closer to regulatory minimums and hindering their ability to withstand any problems from borrowers who are struggling to repay their loans.

The upside for the banks is that bond sales mean fresh cash inflows, which they can plow into options that pay far more than low-yielding bonds and help their profitability going forward. Even just sitting on their cash will pay banks upwards of 5%.

“Fundamentally, it is a math problem,” said Robert Klingler, a bank lawyer at the firm Nelson Mullins. “Do you take less capital now in exchange for increased earnings going forward, or do you have to sacrifice those future earnings to maintain the regulatory capital today?”

In the weeks after Silicon Valley Bank’s failure, some banks decided to take the upfront hit and sell some of their underwater bonds. The move wasn’t without risk, given that SVB’s collapse was sparked by its announcement that it would sell some of its underwater bonds.

But the banks that sold shortly after SVB’s demise had good timing. The recent rise in long-term rates means they would’ve received less money if they had sold later.

The numbers are tougher for those banks with deeply underwater bond portfolios, since the hit they would take to their capital from sales would put them at troubling levels. But for other lenders with more capital flexibility, the math may still work, even if higher rates make the sales less lucrative.

Some banks have stuck more of their purchases into the “held-to-maturity” accounting category, which limits their options, since any sales from that bucket can prompt them to absorb losses on the whole portfolio. Banks that stashed more of their bonds in the “available-for-sale” category have more flexibility.

One relative bright spot for banks: Their unrealized losses are slightly less of an impediment to mergers than was the case earlier this year.

Even before SVB’s failure, bank merger activity was slowing due to the impact of unrealized losses. Under accounting rules, companies are forced to update the value of their assets during mergers — so banks’ unrealized losses are crystallized as their bonds and loans get updated to today’s prices.

PacWest Bancorp in Los Angeles was one of the banks that came under severe stress this spring. Arranging its proposed sale to Banc of California this summer required bringing in a couple of private equity firms and undertaking an accounting maneuver that blunted the impact of unrealized losses.

Another M&A deal announced over the summer, Atlantic Union Bankshares’ planned purchase of American National Bankshares, has led to renewed confidence in dealmaking.

While Atlantic Union expects to take a hit from updating the target bank’s assets to their current values, executives at the acquiring bank said they can earn that money back relatively quickly through improved earnings.

Investors reacted positively to the announcement, which analysts and lawyers say instilled confidence that mergers are possible today despite the impact of unrealized losses.

At a recent meeting with investors and more than a dozen banks with a presence in Texas, M&A chatter returned “in a big way,” Stephen Scouten, an analyst at Piper Sandler, wrote in a research note.

Interest among bankers looking to sell makes sense, according to Scouten. He pointed to exhausted management teams and a tough operating environment, including the impact of underwater bonds.

The more promising sign was that a handful of possible buyers expressed interest in acquisitions. While they don’t want to absorb a massive dilution from their target’s unrealized losses, the bankers expressed some comfort with taking a modest hit for the right deal.

“People wanting to sell is not a surprise,” Scouten said in an interview. “It was more to me that some of these banks were willing and able to undertake the expected dilution.”