Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

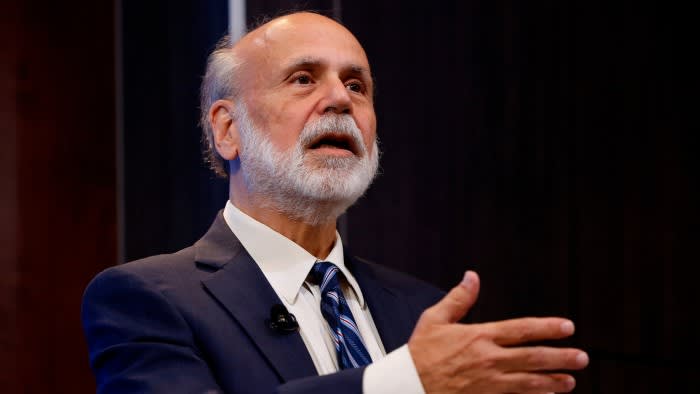

The Bank of England must revamp its main economic model if it is to avoid repeating its recent failure to forecast surging inflation, former Federal Reserve chair Ben Bernanke has said.

The Nobel laureate, who was called in to review the BoE’s forecasting and related processes, found “significant shortcomings” in the bank’s baseline economic model.

He added that the MPC’s current “fan charts” — which show the probabilities of different outcomes for growth and inflation under various assumptions — had “outlived their usefulness” and “should be eliminated”.

Instead, he said, the bank should rely on “more qualitative descriptions of risks and uncertainty surrounding the outlook”.

Bernanke’s report, published on Friday, also said that outdated software and “a variety of makeshift fixes” had left staff unable to produce alternative scenarios swiftly.

It said the BoE needed to invest money and staff time into modernising such systems as soon as possible, before “replacing or, at minimum, thoroughly revamping” its economic model, known as Compass, in the longer term.

The Bank of England said it was “committed to action” on all 12 of the report’s recommendations and would provide an update on proposed changes by the end of the year.

Andrew Bailey, BoE governor, described the report as a “once in a generation opportunity” to update forecasting approaches and tailor them to a “more uncertain world”.

Bernanke was asked to review the BoE’s forecasting last year after UK policymakers came under heavy fire for failing to foresee a post-pandemic jump in inflation that was even sharper and more prolonged than in other advanced economies.

His recommendations suggest that radical change is needed to equip the central bank for a more volatile economic environment, where shocks such as the Covid-19 pandemic and Ukraine war may be bigger and more frequent.

Bernanke said an international comparison showed the BoE’s forecasting performance had been no worse than that of other central banks, and that “unusually large” errors were “probably inevitable” given the unprecedented circumstances.

But the review also points to big deficiencies in the BoE’s forecasting infrastructure, the way it deploys staff, and its over-reliance on a central economic forecast to explain its policy decisions to the public.

Bernanke argued that better forecasting tools would allow the BoE to make more fundamental changes, including supplementing the central forecast with a wider range of alternative scenarios.

He said that publishing a range of scenarios instead of the fan charts would help the monetary policy committee explain its choices, the risks to its forecast and the “robustness” of plans in the face of uncertainty.

Such scenarios would include the effects of alternative policy choices, or unexpected changes in the outside world.

However, Bernanke held back from recommending that the BoE adopt the so-called dot plot, which he introduced at the Fed in the aftermath of the global financial crisis. The chart shows officials’ differing expectations for appropriate interest rate policy in the coming years.

Making any such change at the BoE would be “highly consequential”, he said, arguing that the decision should be left for “future deliberations”.

He said the BoE should focus first on improving its forecasting tools — which will require heavy investment — while “moving cautiously in adopting changes to policymaking and communications”.